Picture this:

You check your bank balance mid-month and panic because you can’t remember where the money went. It’s not uncommon—bills, groceries, subscription renewals, dining out with friends… the list just keeps growing. By the end of the month, you’re barely breaking even. And savings? Forget about it.

But here’s the thing: You don’t need a finance degree to get your money under control. You also don’t need to spend money to manage your money. That’s where the Top Free Personal Finance Software can really make a difference.

These tools act like personal finance sidekicks. They help you:

- See exactly where your money is going

- Check how much is left for fun things

- Remind you when bills are due

- Help you save—and spend—more intentionally

And the best part? They cost nothing to use.

Why Free Finance Tools Are a Smart Move

These aren’t gimmicky apps or flashy marketing tools. They’re solid, user-friendly, and built to make your life easier—not more complicated. Let’s walk through some reasons to use one:

Fewer Guessing Games

Instead of constantly wondering, “Am I overspending?” you’ll know. You’ll have clarity on your money.

Everything in One Place

No more bouncing between banking apps or spreadsheets. These tools combine all your accounts and transactions, so you have a full view at a glance.

Stay Ahead of Payments

Forgot to pay your phone bill? These tools can remind you so you avoid annoying late fees.

Saving Becomes Real

When you set a goal—say, a ₹10,000 trip or some emergency cash—the tool shows you exactly how close you are. It takes the guesswork out of saving.

These apps lighten the load, not add to it. And if it saves you just a little time and stress each month, that’s already a win.

Why It Matters Right Now?

Let’s get real—tracking money isn’t just for business owners or high earners. It’s for anyone juggling expenses—and who’s not feeling quite in control.

Tracking helps avoid hidden habits

- That ₹200 daily coffee might not feel big… but over a month, it’s nearly ₹6,000.

- That extra subscription or midnight delivery order? Adds up silently.

When you see the numbers, you make smarter choices—without feeling deprived.

It builds better habits

A small check-in once a week is powerful. It becomes a habit that keeps things on track without taking over your life.

Plan for surprises

Car break down? Phone repair? Emergency vet visit? Happening-by-surprise expenses can sink your budget. Knowing exactly what you spend means you can prepare for surprises—before they hit.

What to Look for in a User-Friendly Finance Tool

These tools come with tons of features, but only some really matter when you’re starting out. Focus on features that actually help you feel better about your money, without over-complicating things.

Simplicity is key

You should be able to understand the layout in just a few minutes. Spend your time living your life, not decoding graphs and menus.

Look for: Clean dashboards, clear labels, big buttons, uncomplicated menus.

Automated tracking

The less you enter manually, the better. The tool should connect with your bank and credit card accounts and update your spending automatically.

Your real spending breakdown

You want to see exactly what you’re spending on—rent, food, bills, fun stuff. A good app shows these automatically, or lets you categorize easily.

Goals and savings built in

If you want to save for something—movies, a scooter, a small fund—pick a tool that lets you set goals and track progress.

Bill reminders

Missed due dates are stressful and costly. Your app should remind you before bills arrive so you’re never surprised.

Strong security

This isn’t optional. Bank-grade encryption, two-factor authentication, and solid company trust matter.

Supports you long-term

Once you’ve used a tool for a month, it becomes part of your routine. Pick one you’ll keep using next month… and six months from now.

Top Free Personal Finance Software

Here’s a breakdown of the most popular free finance tools—and why they’re worth trying. I’ll keep it detailed, but still easy to read:

Mint

- What it does: Syncs with almost all banks, tracks your spending, budgets automatically, and even checks your credit score.

- Why it stands out: One app gives you everything—overview, details, goals, reminders.

- What to be aware of: Displays some ads and offers, which some users find slightly distracting.

- Best if: You want a holistic view without hopping between apps.

Key tips

- Use Mint’s “Trends” to easily compare your monthly spending categories.

- Set up email alerts for overspending or low balances.

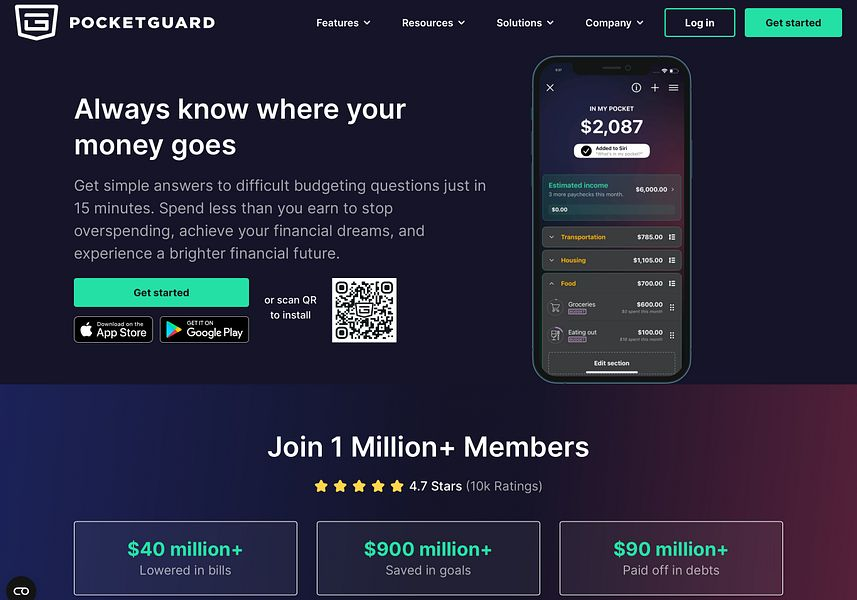

PocketGuard

- What it does: Calculates exactly how much “spare money” you have left after bills, savings, and essentials.

- Why it works: It helps stop reckless spenders from overshooting budgets. Big-picture control in real time.

- What to be aware of: Doesn’t track investments or long-term goals—designed for daily use.

- Best if: You need a simple, daily check-in before you spend.

Key insights

- Consider setting a daily “safe spending” amount—this tool makes it clear.

- Pair with budgeting categories for more structure.

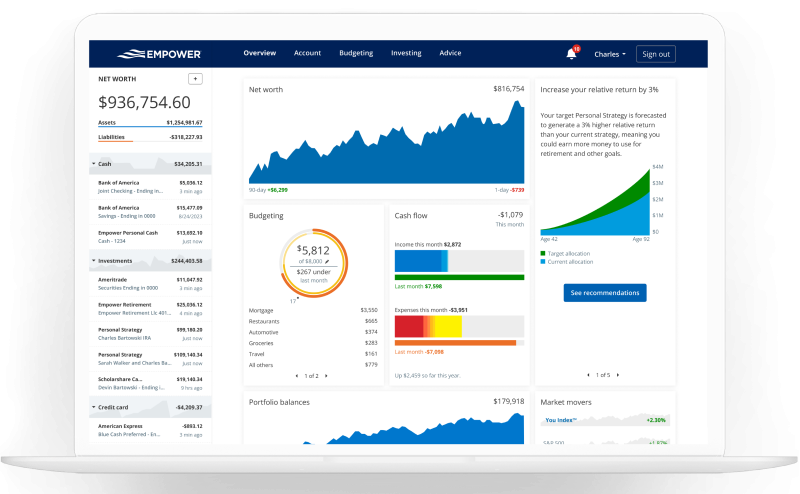

Personal Capital

- What it does: Tracks your net worth, investments, retirement goals—and still gives basic budgeting.

- Why it works: It’s perfect for people who want to watch their long-term money growth.

- What to note: Less emphasis on daily expense tracking.

- Best if: You already budget well and want to grow your money.

Pro tip: Use their retirement calculator tool—it shows how small monthly changes can grow huge long-term results.

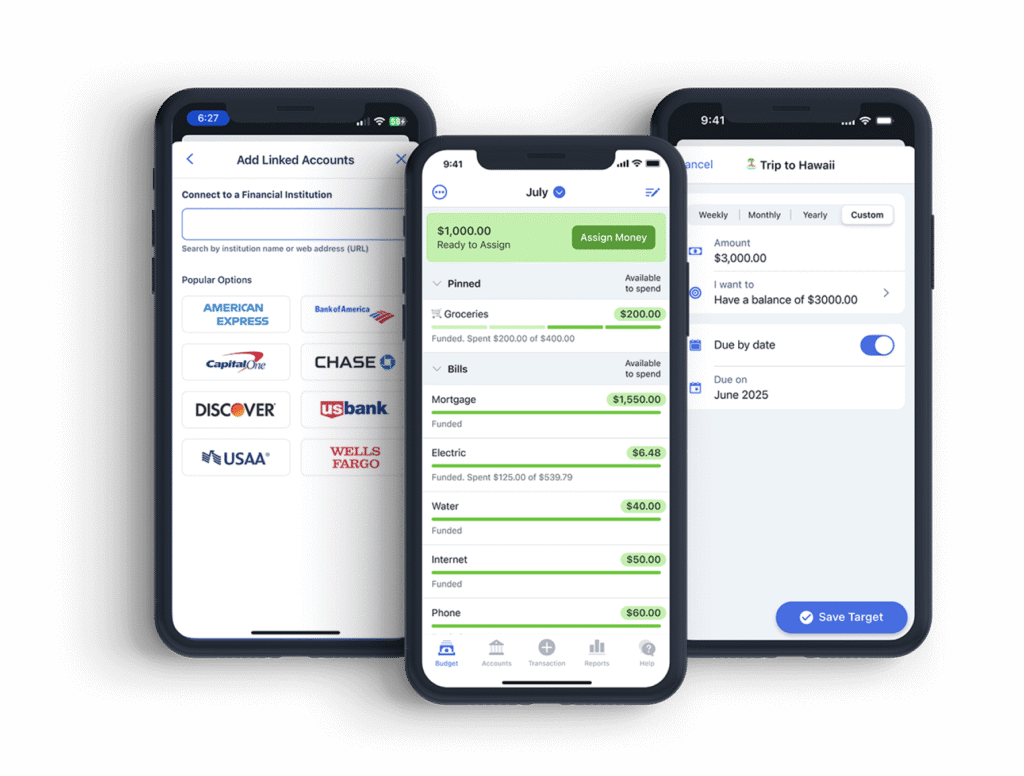

YNAB (You Need A Budget)

- What it does: Forces you to allocate every rupee to a category—zero-based budgeting.

- Why it works: Builds disciplined habits and ensures no money is “wasted.”

- What to note: Free trial for 34 days, then it’s paid. It’s rewarding, but requires commitment to learn.

- Best if: You’re ready for a change and want to feel totally in control.

Pro tip: YNAB’s education videos and forums are powerful—they help you adopt the system fast.

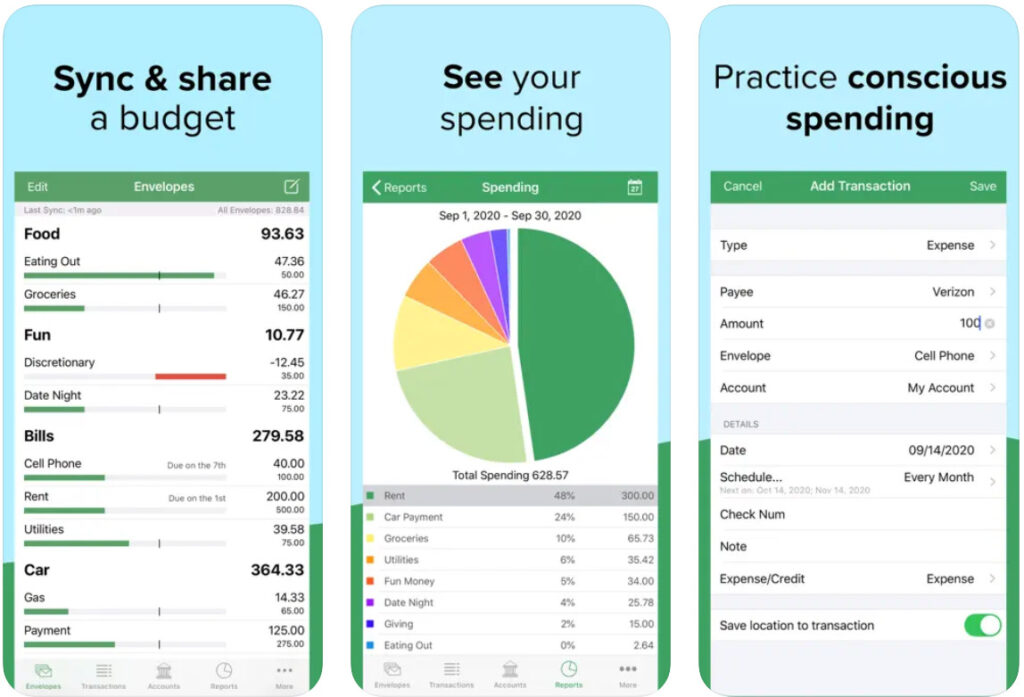

Goodbudget

- What it does: Uses digital “envelopes” for each budget category.

- Why it works: Helps couples, roommates, or anyone who likes hands-on tracking.

- What to note: No automatic syncing—you’ll enter expenses manually.

- Best if: You like seeing tangible progress in each category and handling money personally.

Pro tip: Export envelope reports to track month-over-month changes in how you allocate money.

Truebill (Rocket Money)

- What it does: Tracks subscriptions, helps cancel unused ones, and negotiates bills.

- Why it works: Clears away unnecessary expenses fast.

- What to note: Some features are paid, and effectiveness may vary by region.

- Best if: You know you’ve got too many random subscriptions set up.

Pro tip: Check for long-forgotten trials or low-cost subscriptions—many sneaky charges hide there.

How to Start (without Stressing Out)

If this feels big, don’t worry. Here’s a simple step-by-step plan that anyone can follow:

| Step | Action | Why It Helps |

|---|---|---|

| 1 | Pick one tool | Keeps it simple |

| 2 | Link your main bank account | Automates tracking |

| 3 | View your transactions | Understand habit and spending |

| 4 | Create a simple budget | Even 3–4 categories help |

| 5 | Set a small savings goal | Motivation + progress |

| 6 | Check it weekly | Small time, big impact |

| 7 | Adjust and celebrate | Refine and reward |

Why this works?

Small, consistent steps create real habits. You’ll see progress and feel motivated to keep going.

Stories That Show It Works

Sometimes, all it takes is a small change to finally feel like you’re getting ahead. These stories are from regular people—just like you—who started using free finance tools and saw real results.

Emily’s “Where Did My Money Go?” Moment

Emily always felt like she was running out of money way too fast. One night, she opened up Mint out of curiosity.

What she saw surprised her—she was spending over $100 a month just on snacks at the movies. It didn’t feel like that much at the time, but it clearly added up.

So she made a small change: just one movie night snack per week.

In two months, she saved over $200.

Not by cutting everything out—just by noticing what was going on and making a small shift.

Mark and Sarah Stop the Guessing Game

Mark and Sarah used to argue about money all the time. Bills, groceries, who paid for what—it got stressful.

Then they tried Goodbudget. It let them see all their spending in one place, and they could both add to it from their phones.

It wasn’t fancy. It was just clear.

They started checking in weekly, planning things better, and slowly working on their debt.

In eight months, they paid off over $6,000.

But more importantly, they stopped fighting about money and started talking about it.

Jason Clears the Clutter

Jason never thought he had a spending problem. But when he linked his accounts to Truebill, the app flagged six active subscriptions—some he had not used in forever.

He canceled four of them right away.

That saved him over $25 a month—which he now moves straight into a “weekend fun” fund.

He didn’t have to give anything up. He just stopped paying for things he forgot about.

Moving Beyond Basics

Once you’ve set up a tool and started budgeting, consider these next steps:

Build an Emergency Fund

Even ₹5,000 or ₹10,000 set aside can be a game changer when life surprises you.

How to use your app: Create a goal labeled “Emergency Fund.” To build it, tuck away a small amount from each paycheck.

Pay Off High-Interest Debt

Debt grows quickly thanks to interest. A good budgeting tool helps you carve out extra payments.

Strategy: Check your budget every month to re-allocate more funds toward debt repayment. Track that progress.

Start Investing, Even Small

Once your basic budget is in place, you can begin thinking about investing—even a small amount regularly helps.

Tip: If your app tracks net worth (like Personal Capital), you’ll see your investments in the same space. It makes the journey feel real.

Refine Your Budget Regularly

As your income or expenses change, so should your budget. Adjust every few months to stay in sync with your life changes.

Key Tips for Keeping Momentum

You don’t have to do everything perfectly. Just keep it easy and steady. These small things can help you stay on track:

Treat Yourself Sometimes

- Saved a little money? Nice!

- Go get your favorite coffee. Order pizza. Buy something small you’ve wanted.

- A little reward keeps it fun.

Check Your Budget Once a Week

- Pick a calm time—like Sunday night.

- Look at your app for five minutes. That’s it.

- You’ll feel more in control just knowing what’s going on.

Talk About Your Wins

- Told yourself “no” to something? Paid off a bill?

- Tell a friend. Share it with your partner.

- Saying it out loud feels good—and keeps you going.

Don’t Be Hard on Yourself

- Spent more than you planned? It’s okay.

- Just look at what happened, and adjust next time.

- Budgeting is not about being perfect—it’s just learning as you go.

Final Thoughts

Start small, but be consistent.

Give yourself time to transition into thinking about money in a new way. One week, then two months—suddenly, you’re organized. Confident. In control.

These free tools aren’t perfect—they’re not magical. But they work, if you use them. And all you need to get started is a few minutes today.

Get one. Set it up. Take that first step.

If you want help picking the right one, setting up categories, or customizing for your income and goals—just ask! I’m here to help you start feeling great about your money.

Common Questions Answered

Isn’t financial tracking tedious?

Only at first. Linking accounts and setting up a budget might take 10–15 mins. After that, weekly checks are quick—and empowering.

What if I don’t trust the internet with my bank info?

Choose apps with strong security. If still unsure, use manual-entry tools like Goodbudget. You keep control, but still get clarity.

I’m not tech-savvy. Can I still do this?

Yes! These tools are made for everyone. Just ask me if you get stuck—I’ll walk you through it.

What if I don’t have any savings yet?

That’s okay! Start with just ₹500 or ₹1,000. Small steps matter—especially early on.

I get paid irregularly—will budgeting work for me?

Definitely. Tools like Mint and PocketGuard show your average income and guide your spending. You’ll set a budget based on what’s really coming in.